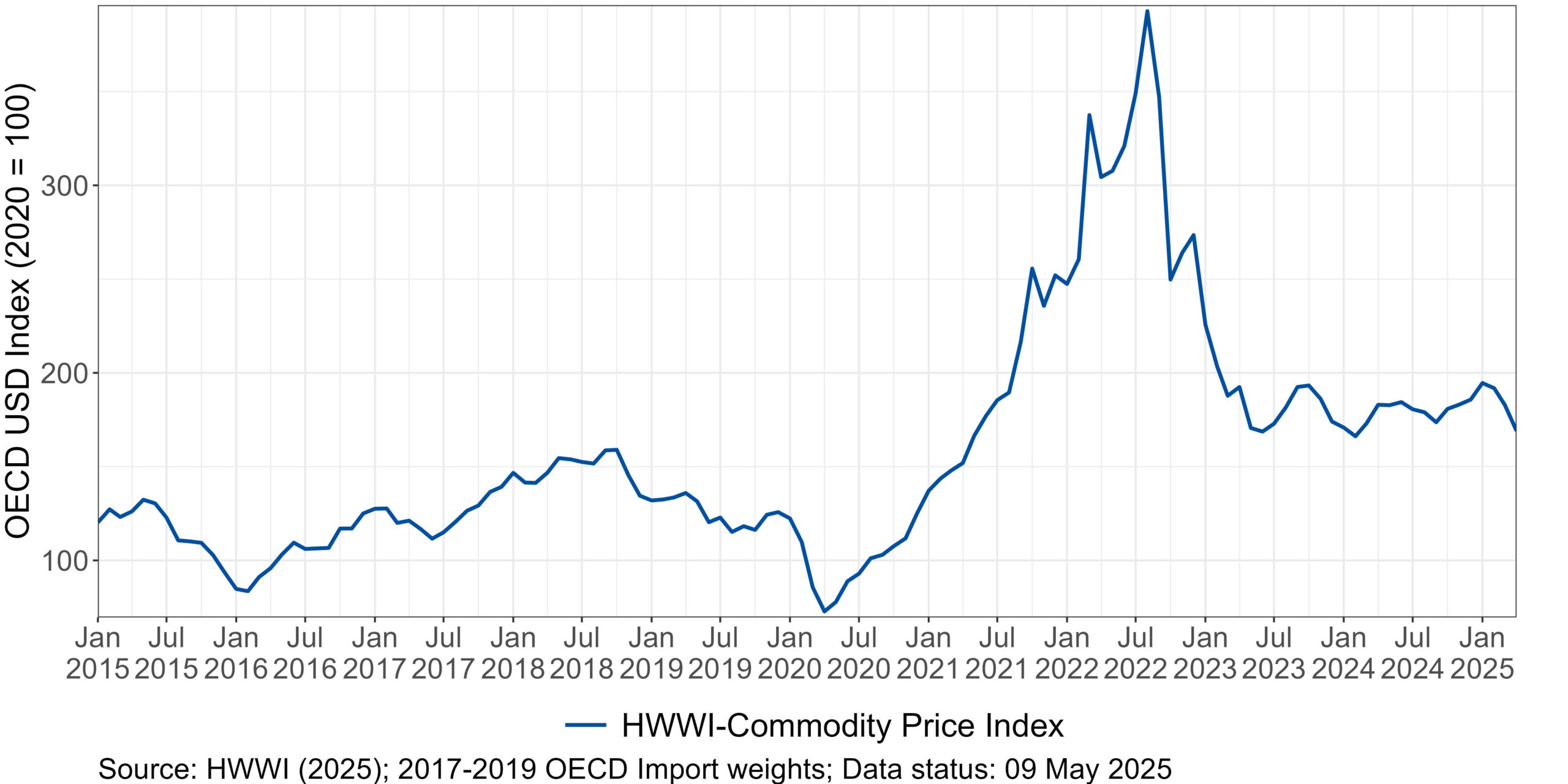

HWWI-Commodity Price Index Declines: Energy Prices Lead the Downturn

After rising continuously since October, the HWWI-Commodity Price Index recorded negative growth rates over the past three months (February: -1.4%, March: -4.6%, and April: -7.6%). As a result, the index stood 7.6% below the level of the same month in the previous year (as of 09 May 2025).

The decline in February was primarily driven by falling energy commodity prices. In March, food prices also declined, averaging -7.1%. By April, energy prices had dropped sharply in some cases (-9.3%), while prices for industrial raw materials also fell, averaging -5.5%.

The index for energy raw materials declined steadily over the past three months (February: -2.6%; March: -5.7%; April: -9.3%), and by April it was 10.3% below the level of the same month in the previous year. European gas prices dropped sharply from March onward, driven by increased LNG deliveries from the U.S. and unseasonably mild weather. In contrast, U.S. gas prices initially rose in March due to cold weather, stronger domestic demand, and rising exports. However, prices there also declined later, mainly as a result of milder conditions, weakening industrial demand—particularly in energy-intensive sectors—and higher U.S. gas production. Despite these developments, the gas index in April remained 40.9% above its level from the previous year.

The trade conflict between the U.S. and China weighed on global economic prospects and exerted downward pressure on crude oil prices. Heightened uncertainty stemming from U.S. tariff policies further intensified this effect. In addition, the announcement by OPEC+ to increase production volumes contributed to the weakening of crude oil prices. As a result, the crude oil index in April was 25.3% lower than in the same month of the previous year.

Coal prices also declined, with the coal index down 24.2% year-on-year in April. This was primarily driven by a combination of weakening demand and oversupply. In China—the world’s largest coal consumer—imports fell significantly in March, as domestic prices dropped to a four-year low and high inventory levels curbed buying. In Europe, coal demand remained subdued as well, due to mild weather conditions and ample LNG supplies.

The food index showed mixed trends, rising slightly in February (1.2%), then decreasing by 7.1% in March, and stagnating in April. As a result, the index is only slightly (1.9%) above the levels of April 2024.

After a prolonged increase, the price of cocoa noticeably declined starting in February. The reason for this is an improved supply situation due to more favorable weather conditions, as well as the expectation of increased production. As a result, stockpiles also rose slightly.

The trade conflict also sparked concerns about a global oversupply, which led to falling grain prices in March.

In addition, the price of rice has consistently fallen in recent months—by up to 8.9%—and is now 29.8% below the price level of April 2024. This decline was caused by an oversupply on the global market after India, one of the world’s largest rice exporters, lifted its export restrictions in March. The downward pressure on prices was further intensified by record harvests in 2024 and high stock levels.

The situation was different for coffee prices, which rose sharply—by 14.6% in February alone—reaching a new record high. This was driven by one of the worst droughts in Brazil, the world’s largest coffee producer, which caused significant crop losses. A poor harvest in Vietnam further worsened the global supply situation and led to declining inventories, while global demand continued to rise.

The price of coconut oil also increased in recent months, by up to 10.5%. This was likewise due to climatic conditions in major producing countries such as the Philippines and Indonesia, which led to a drop in production.

The index for industrial raw materials also showed a mixed picture, rising in February (2.9%) and March (2.6%), but then falling by 5.5% in April. As a result, the index was 2.2% below the level of the same month in the previous year.

Once again during this reporting period, the price development of timber stood out in particular. Canada and the United States reduced their timber production capacities due to poor weather conditions, which tightened global supply, while global demand increased. Supply bottlenecks also caused prices for aluminum, zinc, and lead to rise recently, after having shown a slight downward trend in the preceding months.

Press Contact

Contact

Dr. Marina Eurich