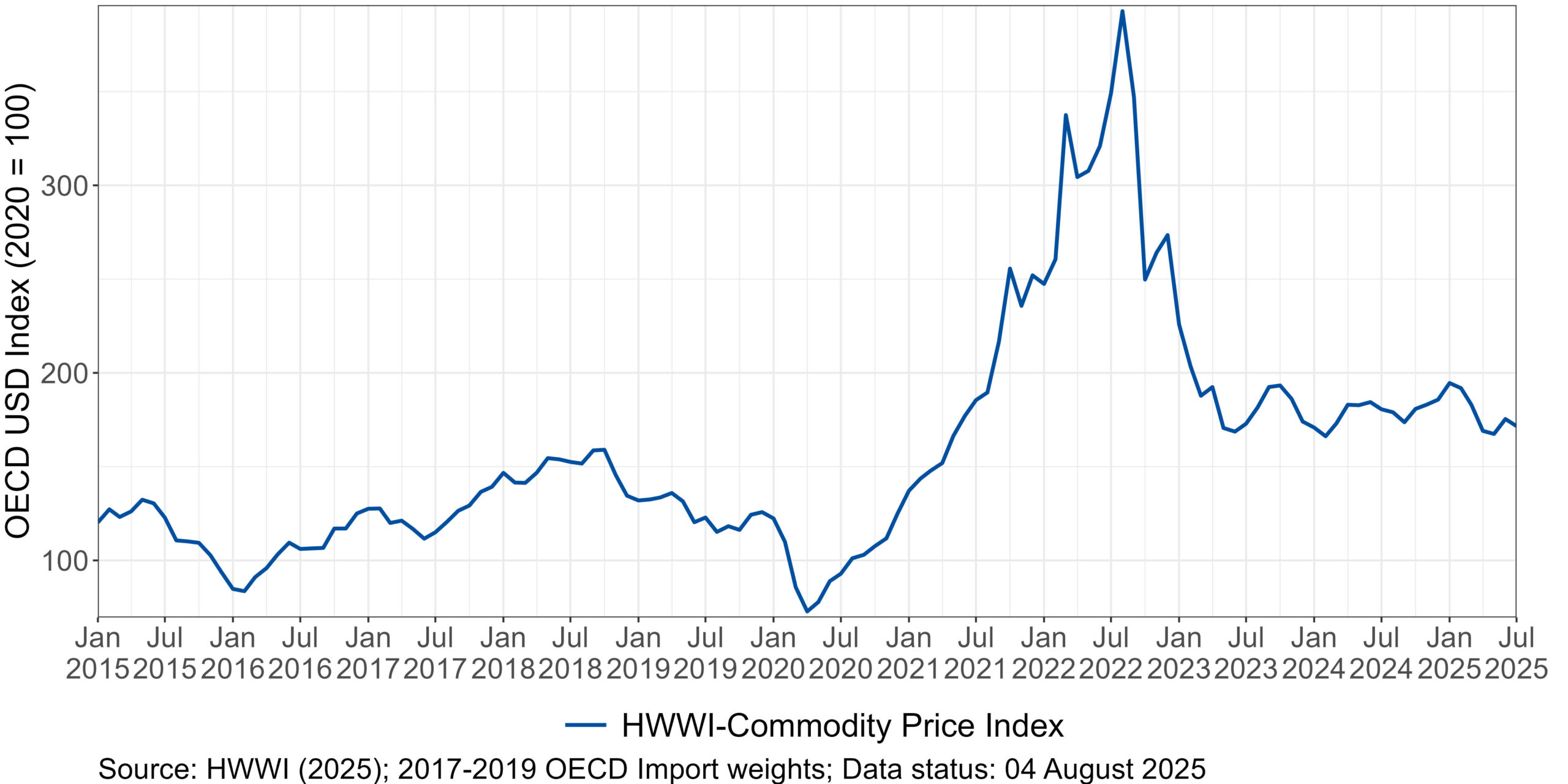

HWWI Commodity Price Index remains at a stable level

After a significant decline in the first half of 2024, the HWWI Commodity Price Index has stabilised at a lower level since the summer. Since then, the index has fluctuated within a narrow range, with temporary increases, such as at the turn of the year, being corrected again. Price movements have been relatively stable in 2025 to date.

In the past three months, the HWWI Commodity Price Index has shown both negative and positive growth rates (May: –1.0%, June: +4.8%, July: –2.2%). In July, the index was approximately 5% below the level of the corresponding month of the previous year (data as of 04/08/2025).

The decline in May was partly due to falling prices for energy commodities (–2.0%). In June, energy prices recovered moderately by 7.5%. In contrast, prices for food and beverages fell by –5.6% on average. In July, food prices declined further by –8.3%. In addition, there was a slight decrease in energy commodities (–2.0%). The index for industrial raw materials remained largely unchanged throughout the reporting period, fluctuating between +0.4% (May) and +1.5% (June/July).

The energy commodity index showed a volatile pattern over the past three months, with alternating upward and downward movements (May: –2.0%, June: +7.5%, July: –2.1%). In July, the index was 7.3% below the level of the same month in the previous year. This fluctuation reflects ongoing geopolitical tensions and economic uncertainties. In addition to continued uncertainty related to US trade policy, the conflict between Iran and Western states led to a noticeable increase in oil prices in June (e.g. approximately +9%). At the same time, OPEC+ significantly intensified its production policy, raising production targets for June, July and August. This resulted in notable supply-side pressure, which further weighed on oil prices. Consequently, the crude oil index in July remained 17.1% below its level of the previous year, despite temporary upward impulses.

In contrast, coal prices developed positively over the reporting period. This marked a recovery from previous lows, which were mainly caused by global oversupply and weak demand. Nevertheless, coal prices in July still stood 16.2% below the level of the previous year.

The food commodity index showed mixed developments: in May, it rose by 3.1%, but fell sharply by –5.6% in June. This downward trend intensified in July, with a further decline of –8.3%. Cocoa prices continued to fall after a previous increase of 10.2% from April to May: prices declined by –6.6% in June and by –12.1% in July. This development coincided with an improved supply situation in West Africa, particularly due to higher arrivals from Côte d’Ivoire and Ghana during the mid-crop harvest. In addition, declining grindings in Asia and Europe contributed to the easing of the market.

A similar pattern was observed in the HWWI coffee price index, which fell by 12.1% in July. Robusta coffee prices dropped by 14.8%, making a key contribution to the overall easing of the situation. As a result, coffee prices moved further away from the record levels observed in the first quarter of 2025. The main reason for the price decline was the rapid progress of the Brazilian harvest, which was already around 90% complete by the end of July and yielded above-average results.

Developments in grain markets also exerted downward pressure on the food index. For example, maize prices declined steadily over the last quarter. Rice prices were still moderately above the previous year’s level in May (+7.7%) and June (+4.8%), but fell by 31% in July.

The index for industrial raw materials developed slightly positively over the reporting period. While it fell by –1.0% in May, it rose by 4.8% in June and fell by –2.2% in July. Overall, the index stood 2.2% above the level of the previous year in July. For example, copper prices remained relatively stable: July: –0.6%, June: +3.2%, May: +3.7%.

Press Contact

Contact

Dr. Lea Bernhardt