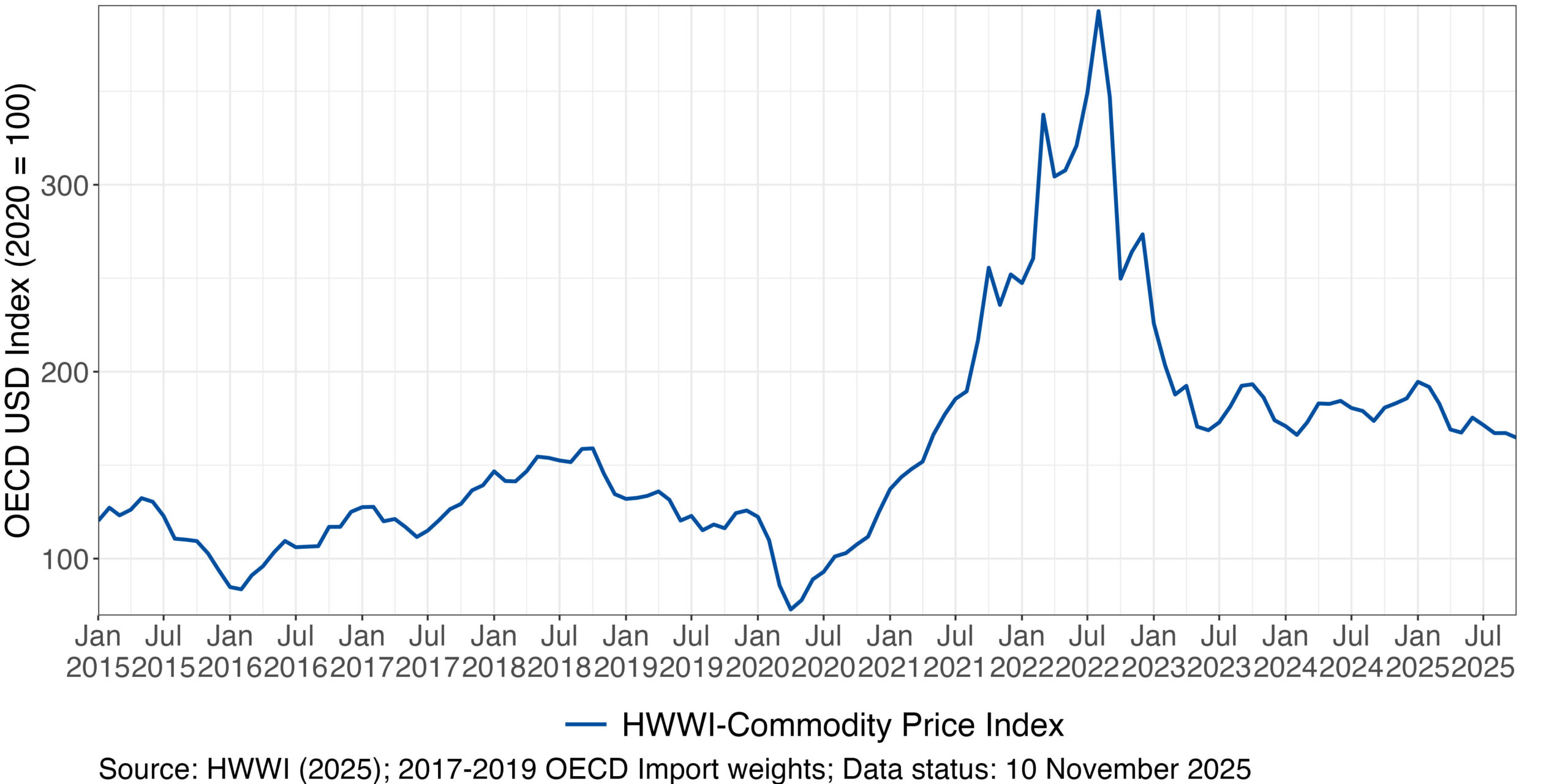

HWWI Commodity Price Index remains stable amid slight downward movement

Over the past three months, the HWWI Commodity Price Index has been under slight downward pressure (August: −2.5 %, September: 0.0 %, October: −1.5 %). In October, the HWWI Commodity Price Index stood around 8.9 % below the level of the corresponding month of the previous year (data as of 10 November 2025).

The slight decline in August is primarily attributable to falling energy commodity prices (−4.1 %). In September, energy commodity prices stabilised (−0.2 %) but resumed their downward trend in October, decreasing by a further 2.5 %. This corresponds to a decline of 13 % compared with October 2024. The predominantly downward movement of the index mainly reflects price developments in coal and crude oil. While crude oil prices fluctuated significantly in the second quarter due to persistent geopolitical tensions, production decisions by OPEC+ shaped the situation in the third quarter. The group of oil-exporting countries repeatedly signalled a further increase in production. As a result, the crude oil index came under pressure, declined by 5.6 % in October, and stood 15.3 % below the previous year’s level at the end of the reporting period.

The coal index showed a downward trend in the third quarter, with changes of −0.3 % in August, −6.6 % in September, and −0.9 % in October.

The food and stimulants index continued its mixed development from the previous quarter but remained relatively stable over the reporting period. In August, it initially rose by 3.2 % and then stagnated in September (+0.7 %). In October, the index reversed this moderate increase and fell by −3.6 %. Overall, the index was slightly above the level of the previous year in October (+1.2 %).

The development of the food index in the third quarter was mainly characterised by moderate fluctuations in stimulants (August: +7.0 %; September: −0.8 %; October: −7.3 %). A sharp rise in coffee prices in August (+14.6 %) initially contributed to the index increase, before the momentum eased noticeably (September: +9.3 %; October: +0.5 %).

In the second half of the reporting period, the index development was mainly influenced by cocoa prices. The previously stable trend in cocoa turned sharply negative in September and October (−7.9 % and −15.0 %, respectively).

The other food subindices were largely stable and dampened the fluctuations caused by the stimulants index. The oils and oilseeds index, for instance, rose moderately in August (+3.8 %) but then remained largely unchanged over the rest of the reporting period (September: +1.8 %; October: −0.2 %).

The industrial raw materials index remained largely stable in August (0.1 %) and September (0.5 %) but rose moderately by 4.0 % in October. The October increase was mainly driven by higher copper prices. Overall, the copper price rose by 7.5 % in October and stood 12.1 % above the previous year’s level. In contrast, timber prices were highly volatile during the reporting period. In August, timber prices rose by 8.7 %, reaching a three-year high due to anticipated tariffs and advanced imports into the United States. Prices then fell by 20.9 % before recovering moderately by 7.2 % in October, thereby providing additional support to the industrial raw materials index.

Press Contact

Contact

Dr. Lea Bernhardt