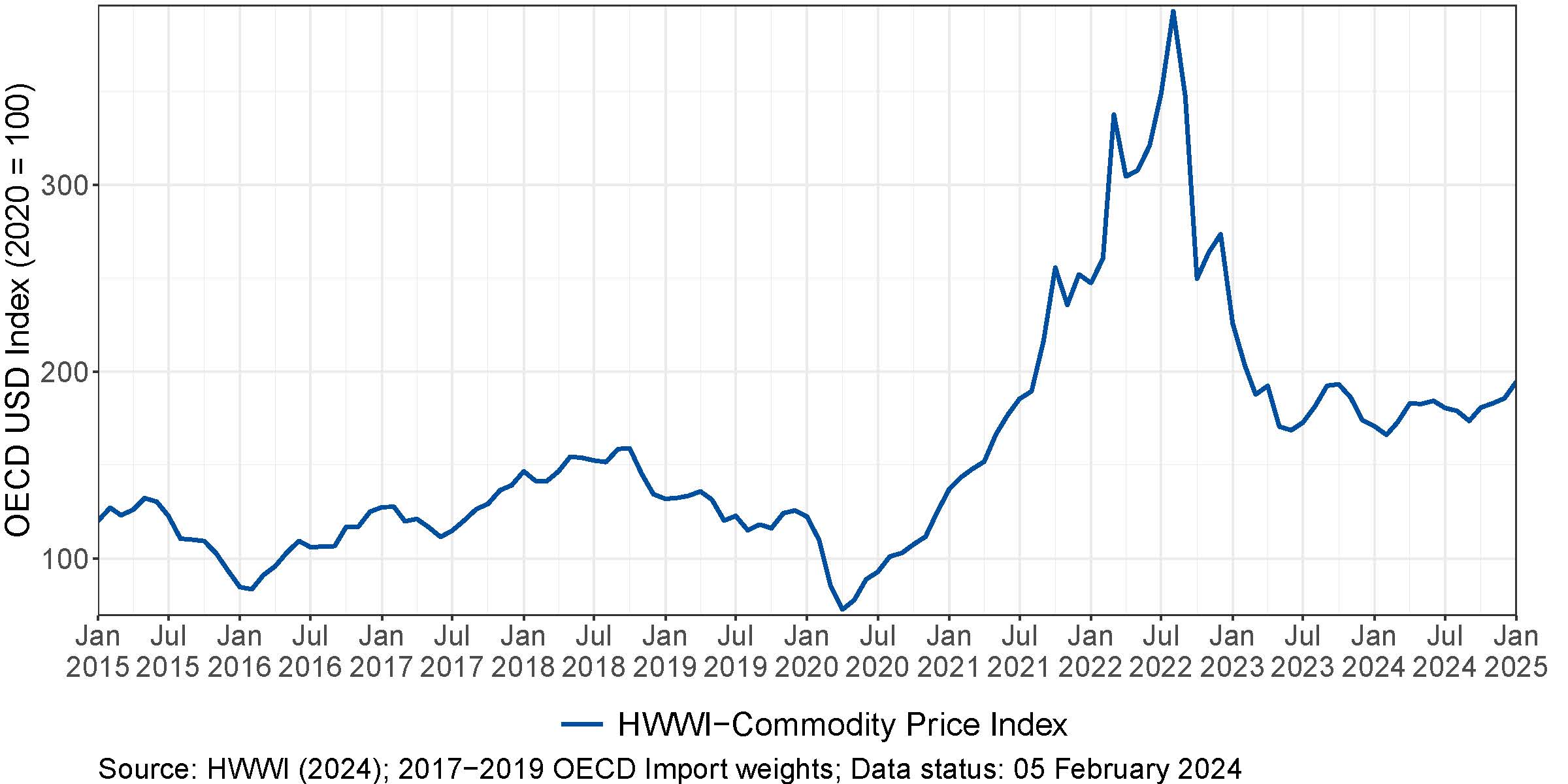

HWWI-Commodity Price Index Continues Upward Trend

The HWWI-Commodity Price Index has recorded a significant increase in recent months, continuing its upward trend since October. In the three reporting months from November to January, the index rose by 1.3%, 1.4% and 4.9% respectively. In January, the index was therefore 14% higher than in the same month of the previous year (as of 5 February 2025).

The increase in January was primarily driven by the sharp rise in energy commodity prices. In December, on the other hand, there was a significant rise in prices for food. In contrast, prices for industrial raw materials declined and have been on a downward trend over the last three months.

The index for energy raw materials has risen exclusively in the last three months (November: 1.4%; December: 0.6%; January: 6.5%) and was therefore 13.6% higher in January than in the same month of the previous year. This increase in January was driven by the price of crude oil, whose index rose by 8.3%. Due to colder temperatures and lower fuel prices, demand for crude oil increased, which drove up prices. Further tightening sanctions on Iranian and Russian oil by the US and UK and the extension of EU sanctions are likely to have put additional pressure on prices.

Of particular note is the rise in the US gas price, which increased significantly in the last three months, rising by 15.9% in November and 14.7% in December and 8.8% in January. The European gas price also recorded an increase, but not to the same extent. The index for Natural gas was therefore 49.5% higher than in January 2024, again due to increased demand as a result of a cold winter and concerns about supply bottlenecks as a result of additional sanctions against Russian gas. In addition, inventories of US natural gas decreased.

The opposite trend was seen in coal prices, which fell significantly in both December and January. The index for coal fell by -7.4% in December and by as much as -9.1% in January. This is primarily due to the high supply of coal from China, which experienced a record year in 2024. In addition, global demand for coal continues to grow more slowly than in previous years, while production volumes continue to rise worldwide.

The food index also continued its upward trend since September and rose in all reporting months (November: 6.2%; December: 10.8%; January: 2.6%). The index was therefore 35.8% higher in January than in the same month of the previous year.

This is primarily due to the sharp rise in prices for cocoa, coffee, palm oil and sugar, which increased significantly with double-digit growth rates in some cases. The price of cocoa reached a new record high in January: the price rose by 31% in December, more than quadrupling since 2020. Unfavourable weather conditions in the most important cocoa-growing countries in West Africa continue to lead to low harvests. Similar factors also contributed to the rise in coffee prices.

The rising demand for palm oil, particularly for biodiesel production, coupled with reduced exports from Indonesia and unfavourable weather conditions in South East Asia, also caused palm oil prices to rise. In November, prices for palm oil rose by up to 18.6%, twice as high as in the previous year.

In contrast, prices for soya meal and soya bean oil fell in this area. The price of soya meal fell by -8% in November, while the price of soya bean oil fell by -7.9% in December. This was due to the still sufficient supply resulting from record harvests in America at a time when demand is falling. However, the price of soya meal rose again slightly in January 2024 and the price of soya oil also increased again in January. Ongoing competitive pressure also led to a further fall in the price of rice (January: -6.9%), meaning that the price is now roughly at the same level as two years ago.

In contrast, the index for industrial raw materials continued to fall and recorded declines in all three reporting months (November: -2.6%; December: -1.1%; January: -1.0%). At 128 points in January, the index was therefore only 2.7% higher than in the same month of the previous year.

In this reporting period, the price trend for wood stands out in particular. Prices rose by 13.9% in November and 3.8% in December, but fell by -5.1% in January. This means that prices are now only 1.2% above the January 2024 level. One possible reason for these fluctuations could still be production cuts.

The slowdown in industrial activity in key economies, particularly in China, led to a further decline in demand for industrial raw materials. Prices for Non-ferrous metals in particular fell. The price of tin, for example, fell by up to -7.6% in November. With the exception of lead and nickel, however, prices are still higher than in the same months last year.

Press Contact

Contact

Dr. Marina Eurich