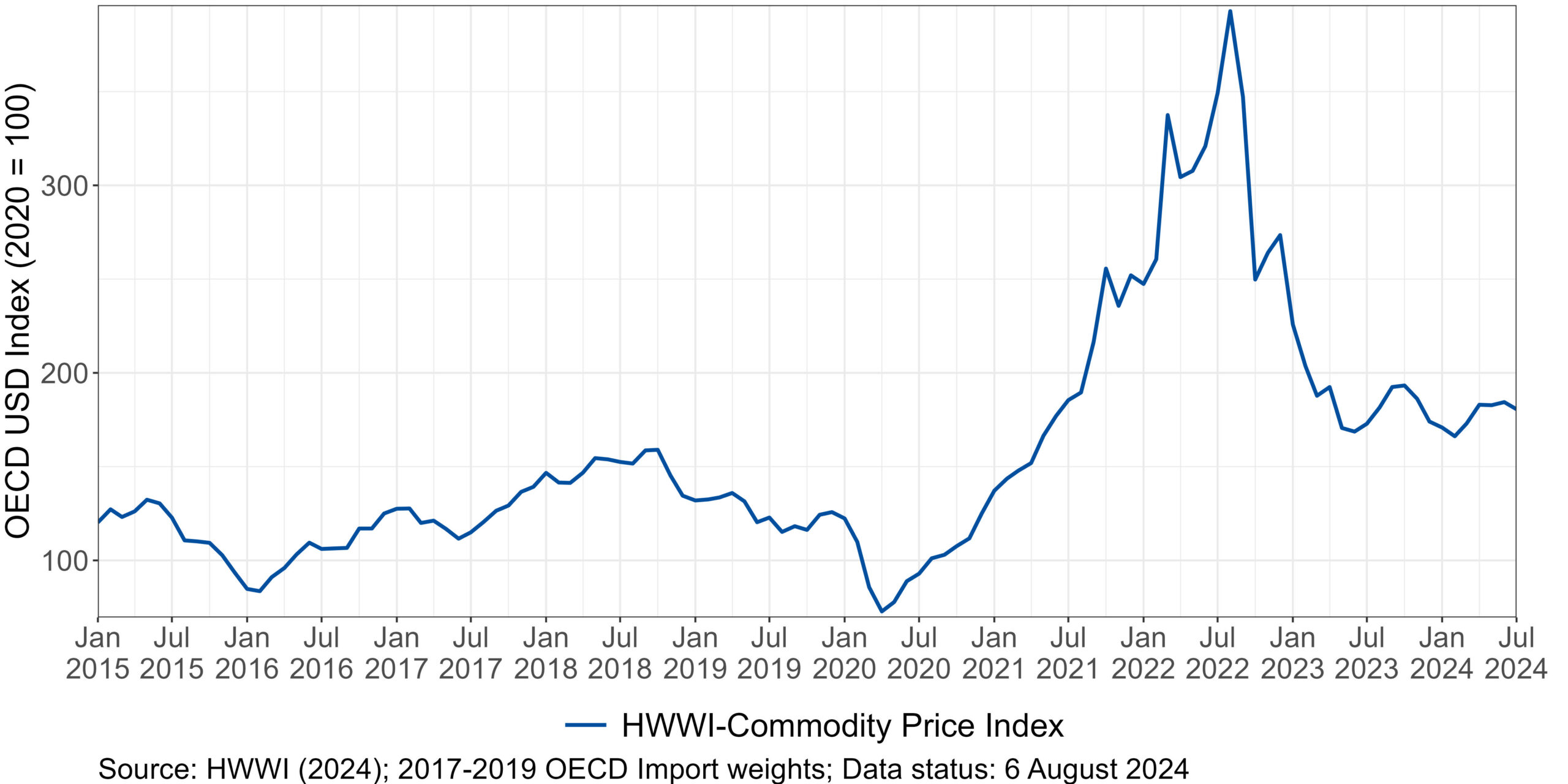

HWWI-Commodity Price Index stabilises at a higher level

After the HWWI-Commodity Price Index rose again in the last reporting period (February to April), the index showed a mixed trend in this reporting period (May to July). The index barely changed in May (-0.1%), rose by 0.9% in June and fell again by -2.1% in July. The HWWI-Commodity Price Index now stands at 180.6 and is thus consistently above the values for the same month of the previous year for the first time since the end of 2022 (May: +7.1%, June: +9.3%, July: +4.5%; as at 6 August 2024).

Fluctuations of the gas price in particular determined the development of the HWWI-Commodity Price Index in this reporting period. Maintenance work and problems with production led to lower supply and therefore higher US gas prices in May compared to the previous month, but also compared to May 2023. Maintenance work and the associated uncertainties also caused the European natural gas price to rise in May, although it is roughly on par with the same month of the previous year. However, rising supply and well-filled storage facilities caused prices to fall again in July. Overall, the index for energy raw materials fell slightly by -0.4% in May, rose by 1.7% in June and then fell again by -1.5% in July, leaving it 6.1% higher on average than in the same month of the previous year.

There is no clear trend in food prices.

Palm oil prices have risen particularly sharply. Although the index value for palm oil fell in May and June for the first time since the beginning of the year, the index rose again in July by 17.8% and is therefore 37.2% higher than the previous year’s value. Palm oil is not only used by the food industry, but in the renewable energy sector. Demand is therefore growing, but is currently being met by a steady supply, which is causing the price to rise.

In addition to palm oil, the price of wheat rose sharply in May. The index value increased by 15.6%. This was probably due to concerns about a poorer harvest due to less favourable weather conditions. However, this concern was only temporary, as better production data from the USA caused the price to fall again in June and July.

Developments in cocoa prices continue to stand out. Since September 2022, the average cocoa price fell again for the first time in May and July. At the current margin, better weather is causing the price to fall slightly due to seasonal rainfall. There are also higher harvests from producing countries such as Ecuador. However, the index for cocoa is still 167.3% higher than in the same month last year.

The price of coffee is also significantly higher compared to the same month last year. The index rose by 8.9% in June and 4.3% in July and is 48.9% higher than in the same month last year. Unfavourable weather conditions in South East Asia (such as droughts in Vietnam) and South America (heavy rainfall in Brazil) also led to a trend of rising prices.

Overall, the food index shows no clear trend. The index fell by -4.7% in May, then rose slightly by 1.4% in June and fell again by -5.7% in July, thus exceeding the previous year’s figures in all three months (up to 13.1% in June).

The index for industrial raw materials rose by 4.2% in May, but then fell again in June and July by -3.0% and -2.1% respectively and is with a value of 129 now above the July 2023 values (+6.3%).

The index for iron ore rose sharply in May (+9.7%) due to high demand from China in particular, but fell again in June by -8.9% and then rose again by 1.2%. Concerns about the recovery of the steel-intensive property sector in China continue to result in lower prices compared to the previous year.

The trade ban imposed by the USA and the UK on imports of Russian aluminium, copper and nickel could still be responsible for rising prices in May. In addition, independence protests in New Caledonia, where a large Nickel deposit is located, are causing concerns about declining production. However, there is still plenty of supply, meaning that prices fell again in June and July and are still below those of the previous year.

The prices of copper and aluminium also fell again in June and July, although both commodities are higher than in the same month last year. The recovery of the global economy and investments in green technologies are leading to a trend of rising demand and prices.

Press Contact

Contact

Marina Eurich